Teach Kids to Save Money- Interview with Lacey Filipich from Money School

Teach Kids to Save Money My kids and their bookworm friends created a book club this year, called 'Imagine Hope and Pepper Stories', where the kids read the same book and talked about it together. One of the books they read was 'Bunny Money' by Lacey White (now Lacey Filipich), founder of Money School. This book is a tool which can teach kids to save money. In a nutshell the book is about two twin bunnies, Nate and Nessa. On their 10th birthday, their Gran opened a savings account for each of them with $100 in each account. Gran says that the real present will come on their 11th birthday, and that she will give them one dollar for every dollar they deposit in to their savings account, as well as an extra $100. Will the bunnies save their money, or will the spend it!? Well, you'll have to read the book yourself HERE! Oh the suspense of it all ;)

Meeting the Author

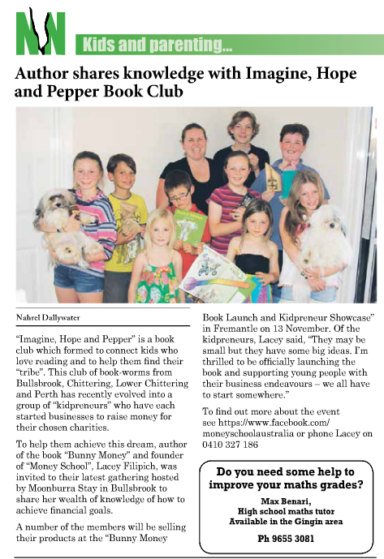

The book club absolutely loved this book, so much, that it inspired them to think about ways they could earn money and save. They were even lucky enough to meet author Lacey Filipich at Moonburra Stay. Lacey shared her story about how she worked hard at earning money as a teenager and saved her money, and because of this she was able to buy an investment property at the age of 19. Through the habit of working hard, saving and investing, Lacey is now able to live of a passive income in her 30's and give generously to charities. Lacey also invited the kids to sell their wares at her Bunny Money Book Launch and Kidpreneur Showcase.

What I find amazing is that Lacey's mum Fran is the one who showed Lacey how to be wise with money! Now I'm inspired to teach kids to save money. Ashleya (10) has her Beauty From Ash's natural lip balm business, and Kale (9) and Jewel (6) are going in as business partners to sell chicken eggs. Teach kids to save money by letting them have a REAL kid business where they get to KEEP the money! Then they will be motivated to work and will learn A LOT. You can read more tips about teaching kids about money from this interview with Lacey Filipich, the Money School expert.

Interview with Lacey Filipich

ME: What are your kids’ names and ages?

LACEY: Zoe, 3. Owen, 1.

ME: What is your favourite food?

LACEY: I love blue cheese, chocolate and broccoli. Not all at the same time.

ME: What’s it like living on a passive income as a mum?

LACEY: Low stress. That’s always been my goal. Not having to worry about where the money is coming from is a wonderful thing. I earn between $40k and $50k a year from my investments, so it’s not like I’m filthy rich, but that’s plenty for my needs. I prefer to spend my luxury money on experiences instead of things. My husband works full time and his income pays for our home in East Fremantle (I can glimpse the ocean from my house – it’s heaven). On just my passive income, we’d still be in a villa on a main road in Bicton. Which would be fine too, but I like this better.

ME: What do you find most challenging and rewarding about being a mum?

LACEY: Challenging – fatigue and the relentless nature of having to repeat things calmly and clearly 100 or even 1,000 times. I am not naturally a patient person. Rewarding – watching them play together. I love their endless curiosity and their interest in how things work. I love it when Zoe asks ‘why?’ Because I get to think about things from first principles and often end up questioning old ingrained habits.

ME: Can you please tell us about Money School?

LACEY: The original ‘money school’ formed when I was a teenager and my mum started teaching me about money and investing as she was learning. She encouraged me to buy my first investment at 19yo, and that’s what set me on the path to financial independence. When I was in my late 20’s, I started earning passive income and I wondered why other people didn’t do this. I’ve concluded it’s because we’re not taught how. I just happened to win the Ovarian Lottery being born to Fran and following her example. Others aren’t so fortunate. I could just have easily followed Dad’s example (he’s just come out of bankruptcy).

I wanted to show parents how to teach their kids about money, and that started as writing books (I’ve published a children’s book about saving called Bunny Money). I then moved to teaching face-to-face, which was rewarding and intense. When the kids came along and my time became quite literally invaluable, those teachings became the ‘Achieving Financial Independence’ online course for adults and parents, which I completed earlier this year. I’m so proud of it, and I believe it will change lives.

ME: Why have you chosen to support the cause of youth mental health with proceeds from Money School?

LACEY: My little sister Megan committed suicide when she was 24 years old, over seven years ago now. She struggled with depression for six years. Contributing part of the profits from Money School to mental health is how Mum and I pay tribute to Megan and all the families going through similar challenges. I love the concept of organisations like Growing Change that get people connected to each other and to nature as part of the healing process, and I want to support them. Contributing funds is one way of doing that. I also volunteer my time, for example I sat on the Board of Consumers of Mental Health WA for two years.

ME: Why is it important to teach kids about money and how should parents do it? If parents teach their kids about money now, is it possible that their kids could follow your example and live on a passive income by the time they are in their 30’s?

LACEY: I could write a book about this :) Why? You (parents) must teach your kids about money because no one else will – or should – do it for you. Just like you need to teach them manners, healthy eating, how to manage their emotions and how to have healthy relationships. School is not the place to learn about money, and neither is from a bank whose primary objective is to loan you money. How? Start young. 100 small things done consistently leave their mark. Be deliberate about your words – use ‘we don’t waste money’ instead of ‘we can’t afford it’. Learn with them. Loan them money, charge them interest, and take their stuff if they don’t meet their repayments. Encourage them to be entrepreneurial.

Can their kids become independent by their 30’s? Absolutely. That's what my course is all about! Here are eight behaviours that will stop them from getting there:

- Not saving. I recommend saving at least 50% of everything you earn in your teens, and for as long as you can into adulthood. 10% is not enough unless your target independence age is your mid 60’s.

- Not earning. Kids need to earn their own money. Part-time jobs while studying teach them prioritization as well as helping them work out what they don’t want to do for a job.

- Not planning. Failure to understand the true cost of life derails so many young people. A car is not a car – it’s a commitment to pay fuel, maintenance, insurance and registration.

- Bad debt. Unless it puts money in your pocket, whatever you’re buying on your credit card or with a personal loan is bad debt. Don’t. Do. It. Save what you need to buy it outright or go without until you have a passive income that supports you.

- Not trying. I leapt into property at 19yo and made so many mistakes it’s amazing that I didn’t bankrupt myself. Imagine if I did that in my mid 30’s? Get in there with real money while you’re young when the impact of failure is low.

- Not negotiating. On everything. I ask for $4 off my vacuum bags. If you can’t negotiate effectively, you will pay too much for your home, and you won’t be paid what you’re worth at work.

- Not adapting. Times are changing. Growth is slowing, debt is growing. This calls for a different strategy from the past decade.

- Not talking about it. The ‘it’s bad to talk about money’ taboo is handicapping you. Respectful, constructive discussions about money need to be part of your dinner routine.

Ben and Holly from ILOOMinate Perth made about $40 each selling loom bands at the Bunny Money book launch.

ME: Is it possible for a single mum to retire comfortably one day and do you have any other advice for single mums?

LACEY: Yes. My mum is a case in point. She started investing in her late 40’s, now in her mid 60’s she’s a self-funded retiree and she tells me she’s ‘quite comfortable, thank you.’

Saving is hard when you’re the sole provider and there’s no back up. Mum’s message is don’t panic and try not to worry – one day there will be extra money, and when there is, that’s when you need to get started investing.

ME: Can you please share your mini-retirement idea and what have you got planned for you next one?

LACEY: Another one I could write a book on :) Fortunately someone else has done that already, it’s called ‘The Four Hour Workweek’ by Tim Ferriss. Doesn’t it seem a little crazy that we work so hard in the prime of our life so we can lie back and relax – or travel, or spend time with our grandkids – when we’re old and grey? Mini-retirements address this craziness by bringing some of that end-of-life retirement time into your youth so you can enjoy it when you’re young and healthy.

I’ve had five mini-retirements totalling 22 months (all pre-kids – being at home with the kids doesn’t count as a mini-retirement in my book). It’s awesome, I highly recommend it. We haven’t had a mini-retirement since the kids, so next year we’re planning to spend around three months living overseas with them. We’d like to live in Italy, or perhaps Argentina. We’ll base ourselves somewhere in the countryside and then do short trips to visit interesting spots from there. While we’re gone, we’ll probably rent out our house on AirBnB or similar.

ME: If a genie could grant you three wishes what would they be?

LACEY: For the world: a safe, kind and equitable means of population control so we can take the pressure off our planet and find a way to all live sustainably.

For my family: To be kind in what we say and do – to each other, to those around us.

For me: To be able to score goals on the soccer field (I’m sick of playing defence) and enough time and privacy to put what I’m learning at omgyes.com into practice, preferably with my husband ;)

Teach Kids to Save Money

So it does pay off when you teach kids to save money. As a parent, think of yourself like Lacey's mum Fran, and think of your child like Lacey. If you teach kids to save money at a young age it will become an ingrained habit and they could be living off a passive income in their 30's like Lacey! It's never too late for us as parents. You can set a good example for your kids and start saving an investing as an adult like Fran! Collectively, the 12 kidpreneurs at the showcase made around $700 in two hours! What are some ways you could teach kids to save money?